Walt Disney World hotel availability is limited for certain dates in late 2025 and 2026, prompting reader questions and concerns about crowds. This post looks at what’s up the sold out resorts, how to book dates that appear unavailable, and explanations as to why this happens.

If this sounds like deja vu all over again, that’s because we’ve covered this topic twice before. First when “revenge travel” was all the rage and readers were surprised that resorts were selling out without discounts. It’s also come up more recently at times when we’ve predicted low to moderate crowds, and planners have been worried that sold out hotels signaled crowds would actually be heavy.

This is a somewhat valid concern! Walt Disney World has roughly 30,000 hotel rooms, supply has not been constrained in any meaningful way for a while, and demand is not artificially heighted due to people making up for lost time. Given that there are now more available rooms in the inventory and theoretically fewer people competing for said accommodations…what gives? Why are resorts still selling out at Walt Disney World?

Let’s start by discussing Walt Disney World occupancy statistics. If you dig through the Walt Disney Company’s financials, this is something you can actually find buried in the documents on their Investor Relations page.

I’ve been wanting to compile this data for my own reference for a while, so here it is (analysis follows).

Walt Disney World Resort Occupancy By Year

- 2013: 79%

- 2014: 83%

- 2015: 87%

- 2016: 89%

- 2017: 88%

- 2018: 88%

- 2019: 90%

- 2020: 43%

- 2021: 42%

- 2022: 82%

- 2023: 85%

- 2024: 85%

A couple of things are worth noting here. The first is that 2020-2021 are obvious outliers due to the COVID closure and phased reopening. I would be really curious to see occupancy for January and February 2020, because my gut is that Walt Disney World set a record then. The last few months of 2019 into early 2020 were the busiest we’ve ever seen Walt Disney World.

Second, these numbers are domestic occupancy as a whole, which includes Disneyland Resort. However, Disneyland has under 3,000 hotel rooms whereas Walt Disney World has ten times that number. So for all intents and purposes, those numbers reflect Walt Disney World. (I would also be surprised if there’s a major difference in occupancy between the two.)

Third, all of these numbers are higher than the Orlando market as a whole. Last year’s occupancy was 71.6% according to VisitOrlando, which was down 1.1% from 2023, but still historically high and considered an industry win. Orlando occupancy was 66.1% in 2019.

For reference, Central Florida slightly outperforms the nationwide average, which is notable given the competitive market. This is probably why, in our experience, you can get much more bang for your buck in Orlando than random areas of the country. This might be an unpopular opinion, but given the location near major tourist attractions, but Central Florida hotels as a whole are very reasonably priced relative to their counterparts elsewhere.

It helps tremendously that Orlando does not have meaningful supply constraints and there’s a willingness to build to meet demand, which is unlike a lot of major metros or other desirable tourist destinations. (There’s only so much oceanfront real estate and major metros have few empty parcels, plus restrictive public policy.) Thanks to this, even when Disney-owned hotels are sold out, there’s always availability somewhere nearby that’s high-quality, and usually competitively priced. But we’re straying from the point.

Circling back to Disney’s disclosures, occupancy is based on available room nights. This means resort room inventory that’s actually bookable. It’s worth noting that the closure would not count against that since none of those rooms were bookable. Moreover, the available inventory decreased during the phased reopening since some entire resorts and buildings were taken offline.

Meaning those 43% and 42% numbers are even worse than you might think. (Not only that, but 2020 is propped up by January through mid-March, and 2021 would’ve been buoyed by the strong summer recovery sandwiched between a slow start and finish to the year.)

This is also significant during normal times, as it means room blocks taken out of commission for refurbishments are zeroed out, and not counted against occupancy. Likewise, converting hotel rooms into Disney Vacation Club inventory effectively boosts occupancy stats, as DVC is designed to operate at close to 100% occupancy.

There are valid points to be made with regard to Disney ‘adjusting’ available room nights to boost occupancy stats…but there’s also a lot of conspiratorial nonsense. Some fans contend that this is all a shell game, and has been for the last decade.

No shell game lasts that long, and the bottom line is that Disney is better off having a lower occupancy percentage but selling more room nights than pretending hotels are sold out by taking rooms offline. That might “fool” investors for a quarter or two, but not over a decade.

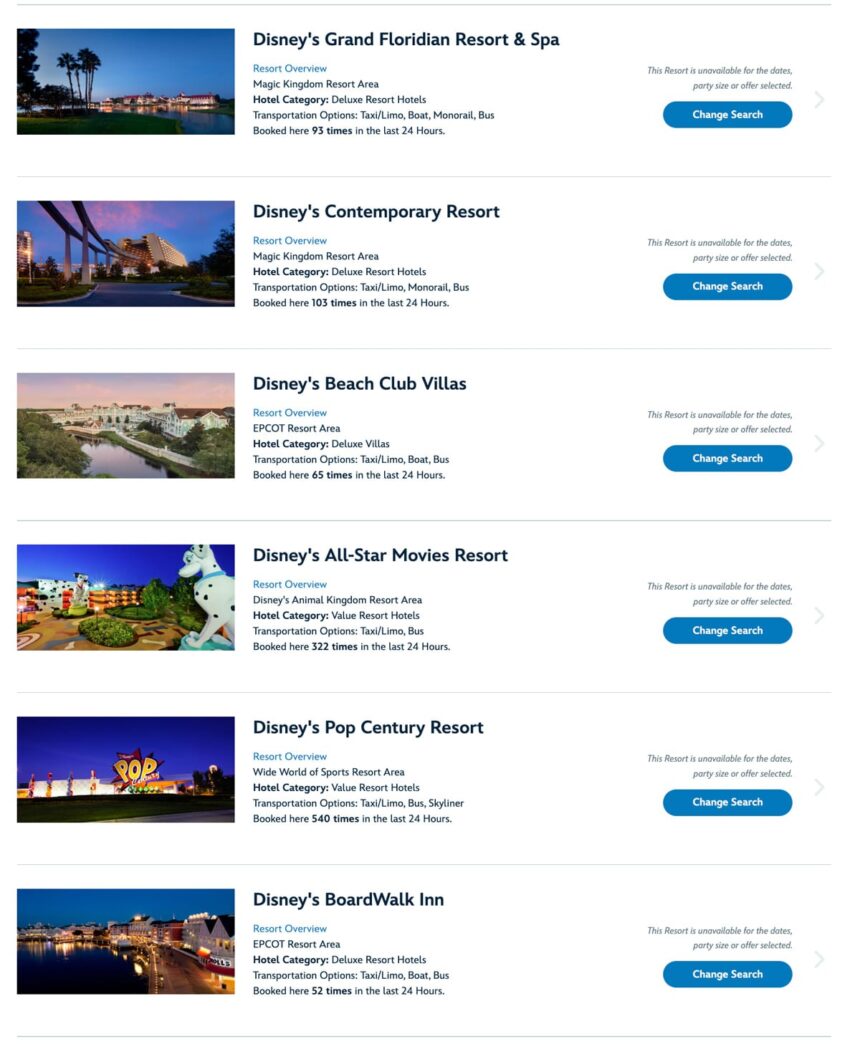

All of this brings us to our main point, which is the common phenomenon of Walt Disney World’s availability looking something like this:

Part of the reason we’re delving into this topic again is because we’ve received a lot of questions, in particular about Christmas season dates. Particularly, why there’s so little availability during our favorite week of the year at Walt Disney World, which we’ve praised for low crowds.

An equally significant part is to offer a heads up for future travel dates or provide assistance in working around this to find availability. Let’s start with the former point, which is that we’d expect to see more and more sold out dates in 2026, even as Walt Disney World gets more aggressive with discounting. These two things might seem at odds, but they aren’t.

During the most recent quarter, the company reported that domestic resort occupancy increased from 83% to 86% year over year (just for Q3). This was despite roughly flat attendance (per the company) and lower crowds (per the wait times data). Notably, this also came amongst aggressive discounts. As we’ve pointed out repeatedly, it was possible to pay the lowest prices for Walt Disney World vacations in over 6 years by stacking available summer deals. (See How to Get the Cheapest Walt Disney World Trip Since 2019.)

This was a rare ‘everyone wins’ scenario for Walt Disney World. Hotel rooms are a perishable good, so pushing up occupancy meant fewer rooms went unfilled, even if they sold at lower rates. That boosted per guest spending since hotels are one of the biggest line-item expenses for vacations. As for higher occupancy not moving the needle on attendance, that’s explained simply by off-site stays shifting to on-site. By and large, vacation demand is not induced by hotel deals–pricing shifts where people stay, not whether they visit in the first place.

It’s also worth noting that some of those 2019 caliber discounts sold out fast. Within a few days of launch, availability was limited to nonexistent at some resorts. Within a few weeks, it was almost completely gone, save for a few stray days here and there.

Vacation planners perusing availability (or lack thereof) for summer might’ve come to the conclusion that those months were going to be jam-packed since there wasn’t much to book. That was not even remotely accurate. June was the slowest month of the year…until July rolled around…until August rolled around. All signs are pointing to September soon dethroning August.

Suffice to say, we know sold out Walt Disney World hotels don’t equal high crowds because this dynamic has played out in the past time and time again, and it didn’t happen. With 130,464 hotel rooms in Orlando, there’s a ton of capacity that feeds Walt Disney World that’s not on-site. The fill-rate at those hotels is what’s outcome determinative, especially since Disney’s numbers are fairly strong throughout the year. (Disney Vacation Club, in particular, has little variance across the calendar.)

Given that Walt Disney World just reported its best Q3 revenue ever, there’s every reason to believe the company will pull from that playbook for future quarters. Expect aggressive discounts (as necessary) to push that occupancy number up, leaving as few unsold rooms as possible.

Another purpose of this post is offering a ‘heads up’ about this and recommending that you not mistake this strategy for a lack of demand. We’ve heard from a lot of readers who are waiting to book until discounts are released, holding off for better deals given the deluge of them lately. This is certainly one strategy, but it’s a risky one if you plan on traveling regardless.

The better approach is to book early and apply special offers when they’re released, if they’re released and there’s inventory for your date, resort and room combo. If not, you can always rebook elsewhere or stay put at your current rate. Absent a time machine, you cannot book something once it’s sold out.

This advice absolutely applies to Winter 2026 travel dates. We know that several of you are waiting for discounts to drop for January through March 2026 travel dates. Special offers for the general public will probably be released within the next 3 weeks.

We also know that same stretch this year was Walt Disney World’s highest 10 weeks of hotel occupancy of the last year. We’ve mentioned this elsewhere, but it’s worth underscoring that those dates are really popular. It’s a combination of shifting travel trends and lower rate seasons, plus special events.

Maybe Walt Disney World will continue the recent trend of historically strong discounts for Winter 2026, but we wouldn’t bank on it. Those weeks are organically strong, so there’s not as much of a need to get as aggressive as this summer. And if they do just to pump occupancy higher, the flip side of that is rooms selling out even faster. Just something worth being aware of if you have firm travel plans but are in ‘wait and see’ mode for special offers. There’s zero downside risk to booking now, but there is in waiting.

On-site hotels selling out completely can cause planners to freak out that the parks are going to be chaotic and crowded. Which can be true…sometimes. But there are a couple of things to keep in mind.

Again, Walt Disney World has ~30,000 hotel rooms, and if you assume 2.5 to 3 guests to a room and a little under 1 park day per night (.75?), on-site guests account for fewer than half of all guests. That’s the back of napkin math of occupancy vs. attendance, but Walt Disney World has also suggested that most guests come from off-site.

This includes those staying in third party hotels around Orlando, but it also includes the growing population in Central Florida and beyond within driving distance. Locals might simply come out for the day when the weather is nice, because there’s a ticket deal, or to enjoy the current flavor of EPCOT’s festival.

Moreover, just because someone is occupying a room at Walt Disney World does not mean they are contributing to crowds. I’ve stayed at Coronado Springs on several occasions when the resort has been slammed, but the buses to the parks have been downright dead. Other times, the resort hasn’t seemed that busy, but the buses have been packed.

The discrepancy is convention-goers, who overwhelm portions of the resort infrastructure (and by infrastructure, I mean bars and hot tubs) but do not attend the parks in the same number as regular ole tourists. The resort could be at ~95% occupancy due to a convention, and it could feel that way in the common areas…but buses could be downright dead. By contrast, the resort could be at ~65% occupancy without a convention, but feel far worse on the buses. It’s all about demographics and the guest mix.

This is why our back of napkin estimate for parks per day is .75 as opposed to 1, and it might be even lower than that. Same goes for the average guest count of 2.5 to 3. That might seem low given Disney’s core demographic of families with kids, but it also accounts for all of the solo conventioneers and growing contingent of Childless Disney Adults. I wouldn’t be surprised if the .75 and 2.5 numbers are both overestimates.

It’s a similar story with youth groups participating in sporting events at the ESPN Wide World of Sports. I’ve said this before, but my contrarian take is that the cheer and dance events at ESPN Wide World of Sports that a lot of planners freak out about have no appreciable impact on overall crowd levels.

It’s entirely anecdotal; horror stories driven by people who have been stuck in line for Haunted Mansion behind hundreds of ‘exuberant’ tweens. I get that. I’ve been there and it’s far scarier than any normal ride on Haunted Mansion.

To some extent, it’s even possible that convention-goers and youth groups are occupying rooms and ‘blocking out’ guests who would otherwise visit the parks. On a more macro level, this has definitely been true with off-site events like the Pro Bowl, which draw people to Orlando and utilize a large percentage of hotel capacity, but are statistically far less likely to visit Walt Disney World than the average visitor.

Now that we’ve covered all of that, let’s turn to some quick tips. First, contrast the above availability with the below–exact same travel dates, searches within 2 minutes:

The key difference is that I did this search logged out, so it didn’t default to showing me the Annual Passholder discount.

In case you’re not aware, special offers pull from different pools of room inventory that are more limited. As we like to point out, Walt Disney World doesn’t offer resort discounts out of generosity; they do so to hit occupancy targets. Accordingly, there’s only so many rooms allocated to special offers; it’s a subset of the total. Those selling out doesn’t necessarily mean that the resort as a whole is sold out…just the discount.

There’s understandable confusion about this, and it’s compounded by the odd user interface choice to not have a discount toggle on this page when searching resort availability as a whole. These toggles do exist on individual resort booking pages, but they’re absent on the main search. Meaning there’s no easy way to see availability as a whole unless you either log out or drill down to specific resorts. This quirk is easy to miss!

Another thing to try is modifying your search to a subset of your actual travel dates.

If booking last-minute, I’ll do 1-night searches, make notes of what’s available each day, and then piece that together in multi-day searches. I will also sometimes increase that to 2-night searches just to confirm Walt Disney World isn’t withholding availability for single nights (it happens).

With this approach, it’s easier to identify the actual night(s) that are sold out, and avoid those. I can do a split stay at two different resorts, or booking a random DVC night at Saratoga or Old Key West or whatever table scraps are available. This might seem chaotic and stressful, but we love split stays–and they’re easier than you might think!

Finally, persistence pays off. Just because you see sold out resorts today doesn’t mean you will tomorrow. Walt Disney World availability comes and goes, as holds are released, rooms reenter the system following refurbishment, cancellations occur, and probably for countless other reasons.

I frequently find myself traveling over Jersey Week and Veterans Day, which I can only assume is one of the highest occupancy times of the entire year. Even months in advance, many/most resorts are often fully booked. Last year, I realized on the morning I was flying out that I had a gap in my accommodations, and quickly scrambled to book something.

Lo and behold, Pop Century was available–a rarity! I snagged it immediately and, come to find out, it probably should not have been available because I discovered Pop Century was overbooked upon arrival. The end result was a free upgrade to Wilderness Lodge and taxi vouchers to transfer. (Not kidding or exaggerating about any of this.)

Ultimately, that should help explain what’s going on with unavailable rooms at Walt Disney World…at least to some degree. More than anything else, this is simply the “new normal.” There’s a higher baseline level of demand, on-site hotel room inventory has not meaningfully increased in a while, and Walt Disney World is pulling more “levers” to keep occupancy as close to 90% as possible.

Even post pent-up demand, people have reevaluated their spending and will continue to prioritize travel for the foreseeable future. Then there’s Epic Universe, which is thus far vindicating the “rising tides lift all ships” theory. That means resort occupancy will remain high in Central Florida, even as tons of new hotels continue being built.

Whether that’s sustainable indefinitely (or through a recession) is another topic for another day, but another one of my unpopular opinions is that, actually, Walt Disney World should be undertaking aggressive resort expansion in addition to the parks projects (and Disney Lakeshore Lodge).

If you’re looking for key takeaways, the first would be that–as discussed above–hotels being sold out does not necessarily mean heavy crowds. It’s certainly a signal that could be the case, but it’s hardly conclusive. Second, don’t view discounts as a sign of low demand; it’s not, so don’t let that lull you into a false sense of security. Finally, book earlier and apply special offers once released, if eligible, to avoid facing this sold out resort problem. Learn from my mistakes and give yourself a bit more lead time.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

Have you encountered lots of sold out resorts at Walt Disney World during a time you didn’t expect to be busy? Thoughts on hotel inventory does or does not impact crowd levels in the parks? Do you agree or disagree with our commentary? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!