Private Capital: Lessons from the Conglomerate Era

Global private capital firms are charting a well-traveled course. With their sprawling…

A Mixed Outlook? The Banking Sector and Its Three Key Drivers

The latest earnings results for banks include words like “record,” “outstanding,” and…

The Alpha Capture Ratio: Rising Interest Rates Mean Pricier Alpha

The rapid ascent of the federal funds rate from near 0% in…

ChatGPT and Large Language Models: Syntax and Semantics

For more on artificial intelligence (AI) in investment management, check out The Handbook…

The Auto Sector’s Green Transition: Three Roads to Lower Returns?

Three investment return trends related to the green transition concern me. These…

Small Caps: Party Like It’s 2000?

The legendary musician Prince exhorted us to “Party like it’s 1999,” but…

How Do Performance Metrics Correlate? Might Fund Managers Cherry-Pick?

Portfolio managers report their risk-adjusted performance using Sharpe, Treynor, information, and Sortino…

The Benefits of Using Economically Meaningful Factors in Financial Data Science

Factor selection is among our most important considerations when building financial models.…

Rethinking Corporate FX Hedging: Seeing the Forest through the Trees

“It often happens that a player carries out a deep and complicated…

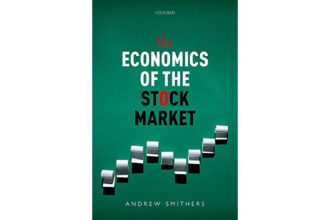

Book Review: The Economics of the Stock Market

The Economics of the Stock Market. 2022. Andrew Smithers. Oxford University Press.…