One of my goals for Fortune is to shine a light on some of the most important industry players through deeply reported profiles. Who are the transformative minds propelling the world’s largest companies forward? Who are the up-and-coming innovators? Some will go on to achieve big things. Others will flame out. All of them will change their industries and shape our futures.

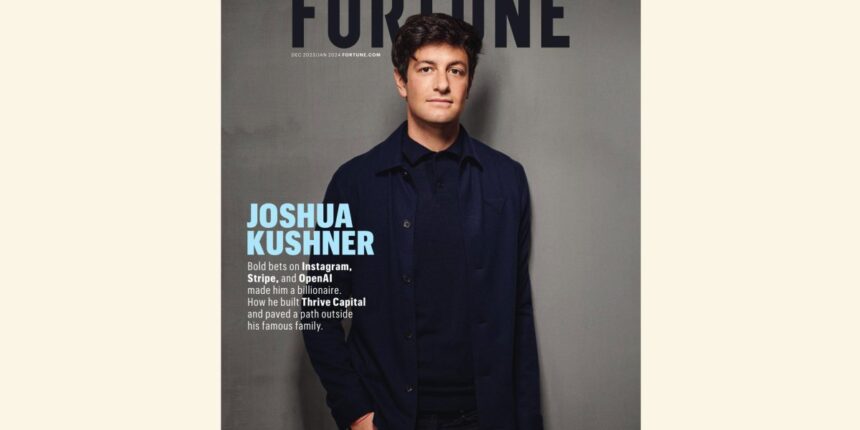

One of the most intriguing young leaders I’ve come across in 15 years of covering tech is a relatively low-profile investor, Joshua Kushner. He founded what’s now a $5.3 billion venture firm, Thrive Capital, and has invested in top-performing startups including Instagram, Slack, Stripe, Spotify, and OpenAI.

I met Kushner in 2009, when he was running a social gaming startup. Since then, he has quietly amassed an enviable portfolio, becoming one of the most financially successful under-40-year-olds in business. His personality is understated but his ambitions are vast, driven by a chip on his shoulder that’s been generations in the making.

His family, the descendants of Holocaust survivors, are famous, for better or for worse. Josh’s real estate mogul dad, Charlie, fell from grace in the early 2000s and served time. Josh’s brother is Donald Trump’s son-in-law, Jared Kushner. Josh’s wife, Karlie Kloss, is a supermodel and businesswoman. Historically, this has all made the youngest Kushner allergic to press, content to operate under the radar.

So I was surprised when, six months ago, he begrudgingly agreed to let Fortune profile him. I set out to answer a few questions. What does he have in common with his more famous family members? What are his values? How does he run his business? How did a kid with little investing experience consistently win over the most in-demand founders and limited partners? Why do some startups call him first even though his firm is far from the biggest or most famous?

In interviews with more than 35 founders, classmates, and competitors, I found that Kushner is a guy who is trusting of few but respected by many. He is unwaveringly loyal toward family, friends, and founders. While he can be inwardly anxious, he is almost pathologically polite, operating like someone who knows he has no reputational room for error. He has carefully but authentically cultivated an image as someone who is humble, generous, and hardworking, who makes the right moves in high-pressure moments for the best long-term outcomes. In a field like venture capital, where your network and reputation dictate your deal flow, he believes “doing the right thing is always the right thing.” The leadership message he hopes to impart: Kindness doesn’t have to come at the expense of capital.

Also in this issue, you’ll find our first-ever Fortune 500 Europe, ranking the continent’s biggest companies by revenue. Europe has been propelled by the energy and auto industries even as war and inflation have been a drag on its economy. The list couldn’t be more different than the currently tech- and health-care-heavy U.S. Fortune 500, which makes it an even more rewarding read.

Alyson Shontell

Editor-in-Chief, Fortune

@ajs

This article appears in the December 2023/January 2024 issue of Fortune with the headline, “A different kind of capitalist.”

A newsletter for the boldest, brightest leaders:

CEO Daily is your weekday morning dossier on the news, trends, and chatter business leaders need to know.

Sign up here.